Protective Life Insurance Guide

LIFE INSURANCE MADE SIMPLE Guide for financial professionals For Financial Professional Use Only. Not for Use With Consumers.

Life insurance might seem complicated – but it doesn’t have to be Life insurance can be a critical part of your clients’ financial and protection planning. Yet 41% of Americans don’t own any type of life insurance — individual or 1 group. Offering protection-focused products that fit your clients’ coverage gaps can be a simple solution for their needs that also helps grow your business. Use this step-by-step guide to discover how easy it can be to offer life insurance, anticipate and meet the needs of your clients, and sustain your business strategy. For Financial Professional Use Only. Not for Use With Consumers.

Table of contents Build your business while protecting your clients with life insurance ..........3 Identify life insurance opportunities ................................................................... 4 Identify opportunities worksheet ........................................................................ 5 Start the conversation with confidence .............................................................. 6 Overcome objections .............................................................................................. 8 Conduct a needs analysis ....................................................................................... 10 Needs analysis worksheet .................................................................................... 11 Understand term versus permanent life insurance ..........................................12 We're with you at every step ................................................................................. 15 For Financial Professional Use Only. Not for Use With Consumers. 1

2 For Financial Professional Use Only. Not for Use With Consumers.

Build your business while protecting your clients with life insurance It’s more than just protection 2 50% of Americans do not currently own any type of life insurance. In fact, you likely have current clients who lack the coverage they would need to protect their loved ones from future financial hardship in the event of an unexpected death. Offering life insurance is a great way to grow your business, increase revenue and retain clients while helping them protect what matters most. Life insurance can provide protection to your clients’ beneficiaries, but can also protect policyholders while they’re still living. This makes life insurance a valuable planning tool for clients - and a valuable revenue stream for your business. Let's take a look at some common reasons clients should purchase life insurance. Discover some of the primary ways life insurance can enhance a client’s financial plan: Short- and long-term protection needs Mortgage Family income Children's protection replacement education Life insurance benefits can Death benefits can be used A properly structured life help survivors maintain for mortgage payments of insurance policy can provide their standard of living, paying off the balance so a college funding in the event despite the loss of earnings client's loved ones can stay of a sudden death. in the event of a client's in their current home. unexpected death. Retirement Legacy planning Living benefits income for your Death benefits can be surviving spouse Some policies offer cash used to leave a legacy for value potential and optional Insurance can help a loved ones or charitable riders that can accelerate surviving spouse continue organizations. the death benefit to help funding for retirement. cover long-term care, chronic, critical and/or terminal illness care. Retirement Business protection Estate Planning income and continuation A buy-sell agreement funded Death benefits can cover Cash value life insurance with life insurance proceeds estate taxes and other policies can be used to can be a powerful tool for liabilities so that survivors supplement income in business continuity. can avoid the sale of assets. retirement. Show clients how attainable life insurance can be - as well as the cost of not having it. Download "Numbers to know" PDF For Financial Professional Use Only. Not for Use With Consumers. 3

Identify life insurance opportunities A simple way to start offering life insurance and increase revenue is by identifying life insurance opportunities that already exist within your client base. Clients who have experienced the lifestyle changes listed below could benefit from life insurance - and you could benefit by being the one to offer it. • Marriage or divorce • Significant changes in their income • Purchasing a new home • Starting, owning or selling a business • Childbirth or adoption • Financial support of an elderly parent(s) • A new job or career change • Nearing retirement • Desire for supplemental savings • Change in tax obligation 44 FFor For Financial Pinancial Prrofofessional Use Onlyessional Use Only. Not f. Not for Use With Cor Use With Consumers.onsumers.

Identify opportunities worksheet Once you begin to listen and identify opportunities, it's important to have a resource to help make sense of it all. This worksheet will help prepare you to facilitate a conversation to get a better sense of your clients’ immediate and long-term needs. Download worksheet page Identified prospects Client Name Married or Single Triggering life event Opportunity For Financial Professional Use Only. Not for Use With Consumers. 5

Start the conversation with confidence It takes practice to start a conversation about life insurance that flows naturally. Rest assured, we're here to help and guide you with these tips and suggestions as you work to develop a strategy that feels right for you. Add life insurance to the agenda This sets a clear expectation that you will be talking about their life insurance needs while discussing their overall financial portfolio. Reference your identifying opportunities worksheet Review how recent life changes might affect your client's life insurance needs. Ask questions that relate to their financial strategy For example, “Have you considered how your family would cover the mortgage if you weren’t around?” 6 For Financial Professional Use Only. Not for Use With Consumers.

Build confidence with conversation starters Use the following prompts and talking points to get the discussion moving in the right direction: Who do you love and what plans have you made to protect them? Let’s discuss their needs and consequences if they were to lose your income. You’ve probably secured enough homeowner’s insurance coverage to replace your home, correct? Of course, no amount of money can replace your life, but what about replacing your income for the ones you love if something were to happen to you? You’ve built quite a business for yourself and your family. How are you and your partner going to maintain the business if something happens to one of you? What is your business continuation plan? I know you took the important step of getting life insurance several years ago. Has your [lifestyle, work, business, family situation] changed since then? Have you reviewed your life insurance coverage since the change(s)? Are there any changes you think you need to make? Make the pivot “Based on what you’re saying, you might benefit from life insurance, let's explore it.” Looking for another way to start the life insurance conversation? Share this quiz with clients ahead of your next meeting. Download quiz For Financial Professional Use Only. Not for Use With Consumers. 7

Overcome objections Even after successfully transitioning the conversation to the topic of life insurance, you may experience client objections. No one likes to think about the what-ifs, especially when it means thinking about unexpected death. But what would happen if they passed away today? Would their family or other loved ones be able to maintain their financial stability? No matter their objections - cold feet, thinking it's too expensive, or not believing they need coverage - make sure you're prepared to navigate the conversation with confidence. The following list captures some of the most common client concerns and conversation prompts that can help you address their objections. 888 FFFor For For Financial Pinancial Pinancial Prrrofofofessional Use Onlyessional Use Onlyessional Use Only. Not f. Not f. Not for Use With Cor Use With Cor Use With Consumers.onsumers.onsumers.

“I can’t afford it.” You may not think you can afford life insurance now, but we can customize a plan to fit within your budget. If cost is a concern, think about what would happen to your family if you’re not around. Would they be able to get by without your income a month after you passed? Did you know that 44% of households would feel financial 1 hardship within six months if the primary wage earner died? That’s where life insurance can help, and I can help you find a policy that meets your needs. “I’m covered through my employer.” You may receive life insurance as part of your employee benefit coverage, but you’re most likely under- insured. These policies are typically only one or two times your salary while many experts recommend having at least ten times your current annual income. Plus, if you leave the job, it’s typically the type of insurance that doesn’t “move on” with you. Do you know if your policy will carry on if you leave? “I don’t have children.” Children are a big reason why people get life insurance, but it’s not the only one. Life insurance can provide living benefits that can help offset costs related to long-term or chronic illness care, and you can use a cash value policy to help fund your retirement. You can also use life insurance to leave a legacy, designating loved ones or a charity to receive the policy’s death benefit. “I’m strong and healthy.” You may not think that those with a healthy lifestyle need life insurance, but that is the best time to get coverage. A serious injury or illness could make it more difÏcult for you to get affordable coverage or any coverage at all. Plus, life insurance is more than just providing a death benefit — you can use it to help fund your retirement, help with business planning and much more. "I'm just not interested." I understand you’re not ready. At a minimum let's do a simple needs analysis that you can review later to help you decide when you’re ready. This is easy to do, doesn’t cost you anything, and will arm you with the right information to make a decision when you’re ready. For Financial Professional Use Only. Not for Use With Consumers. 9

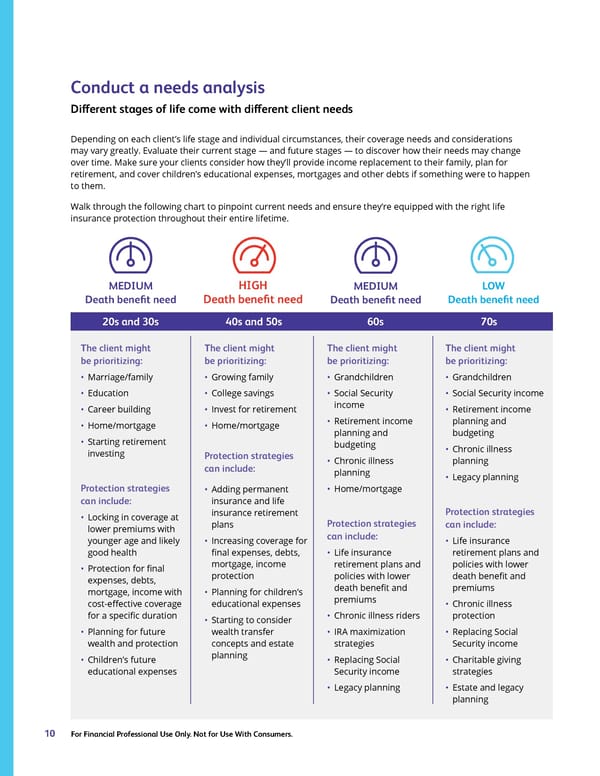

Conduct a needs analysis Different stages of life come with different client needs Depending on each client’s life stage and individual circumstances, their coverage needs and considerations may vary greatly. Evaluate their current stage — and future stages — to discover how their needs may change over time. Make sure your clients consider how they’ll provide income replacement to their family, plan for retirement, and cover children’s educational expenses, mortgages and other debts if something were to happen to them. Walk through the following chart to pinpoint current needs and ensure they’re equipped with the right life insurance protection throughout their entire lifetime. MEDIUM HIGH MEDIUM LOW Death benefit need Death benefit need Death benefit need Death benefit need 20s and 30s 40s and 50s 60s 70s The client might The client might The client might The client might be prioritizing: be prioritizing: be prioritizing: be prioritizing: • Marriage/family • Growing family • Grandchildren • Grandchildren • Education • College savings • Social Security • Social Security income • Career building • Invest for retirement income • Retirement income • Home/mortgage • Home/mortgage • Retirement income planning and • Starting retirement planning and budgeting investing budgeting • Chronic illness Protection strategies • Chronic illness planning can include: planning • Legacy planning Protection strategies • Adding permanent • Home/mortgage can include: insurance and life • Locking in coverage at insurance retirement Protection strategies plans Protection strategies can include: lower premiums with can include: • Increasing coverage for younger age and likely • Life insurance final expenses, debts, good health • Life insurance retirement plans and mortgage, income policies with lower • Protection for final retirement plans and protection death benefit and policies with lower expenses, debts, death benefit and premiums • Planning for children’s mortgage, income with premiums educational expenses cost-effective coverage • Chronic illness for a specific duration • Starting to consider • Chronic illness riders protection • Planning for future wealth transfer • IRA maximization • Replacing Social concepts and estate wealth and protection strategies Security income • Children’s future planning • Replacing Social • Charitable giving educational expenses Security income strategies • Legacy planning • Estate and legacy planning 10 For Financial Professional Use Only. Not for Use With Consumers.

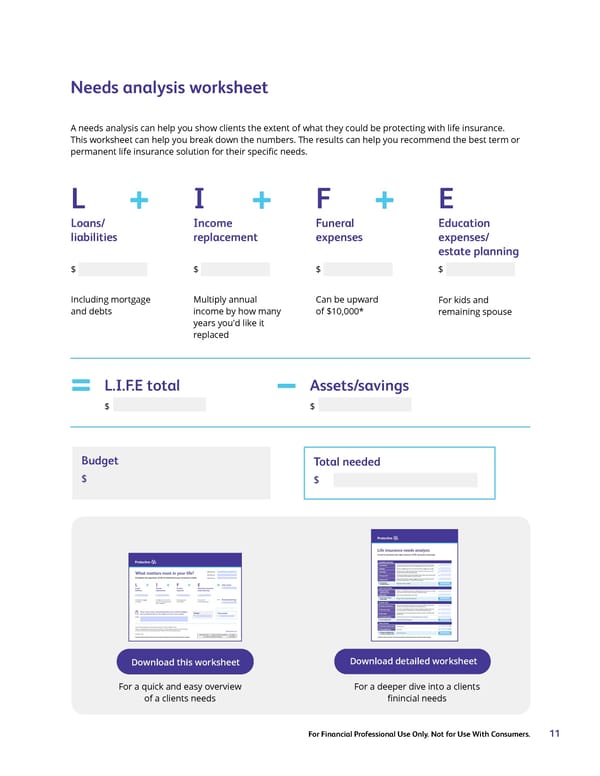

Needs analysis worksheet A needs analysis can help you show clients the extent of what they could be protecting with life insurance. This worksheet can help you break down the numbers. The results can help you recommend the best term or permanent life insurance solution for their specific needs. L + I + F + E Loans/ Income Funeral Education liabilities replacement expenses expenses/ estate planning $ $ $ $ Including mortgage Multiply annual Can be upward For kids and and debts income by how many of $10,000* remaining spouse years you'd like it replaced = L.I.F.E total Assets/savings $ $ Budget Total needed $ $ Download this worksheet Download detailed worksheet For a quick and easy overview For a deeper dive into a clients finincial needs of a clients needs For Financial Professional Use Only. Not for Use With Consumers. 11

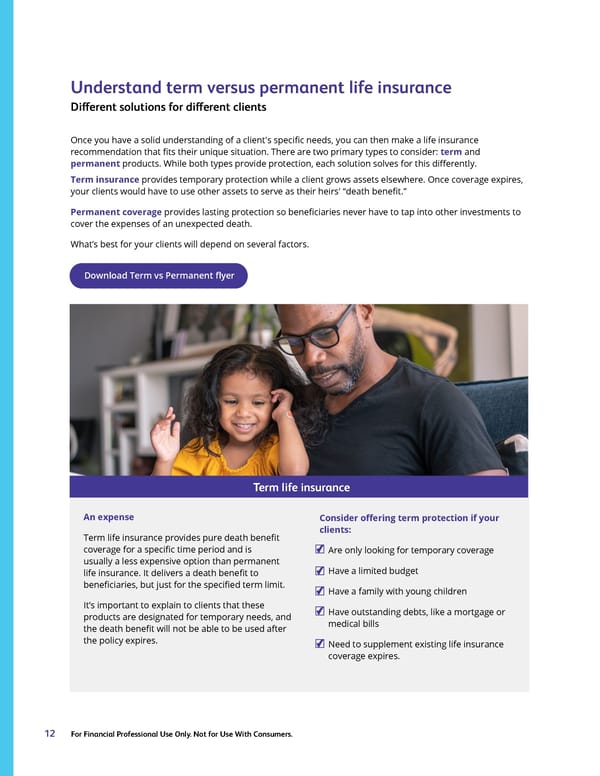

Understand term versus permanent life insurance Different solutions for different clients Once you have a solid understanding of a client's specific needs, you can then make a life insurance recommendation that fits their unique situation. There are two primary types to consider: term and permanent products. While both types provide protection, each solution solves for this differently. Term insurance provides temporary protection while a client grows assets elsewhere. Once coverage expires, your clients would have to use other assets to serve as their heirs' “death benefit.” Permanent coverage provides lasting protection so beneficiaries never have to tap into other investments to cover the expenses of an unexpected death. What’s best for your clients will depend on several factors. Download Term vs Permanent flyer Term life insurance An expense Consider offering term protection if your clients: Term life insurance provides pure death benefit coverage for a specific time period and is Are only looking for temporary coverage usually a less expensive option than permanent Have a limited budget life insurance. It delivers a death benefit to beneficiaries, but just for the specified term limit. Have a family with young children It’s important to explain to clients that these Have outstanding debts, like a mortgage or products are designated for temporary needs, and medical bills the death benefit will not be able to be used after the policy expires. Need to supplement existing life insurance coverage expires. 12 For Financial Professional Use Only. Not for Use With Consumers.

Permanent life insurance Consider offering permanent protection if An asset your clients: Permanent life insurance provides coverage Want coverage to last a lifetime that can last a lifetime and can be tailored to your specific clients’ needs and offer advantages Desire the ability to customize their policy outside of death benefit protection — like a with flexible features guaranteed lifetime death benefit, living benefits like long-term or chronic illness care, and potential Want to add living benefits to their policy for tax-advantaged cash value accumulation and (i.e., long-term care coverage, a chronic income. illness rider, waiver of premium, etc.) Because these solutions provide lasting benefits, Need a solution for advanced planning, it’s important for clients to understand that these such as business continuation or key person products can be considered an asset and become protection. an essential part of their comprehensive financial plan. Are looking for ways to manage their assets using an estate planning strategy This type includes guaranteed universal life, whole life, indexed universal life and variable universal Want both a death benefit and the potential life policies. for tax-advantaged cash value growth Want to access the policy’s cash value for tax-free retirement income Have a desire to fund a wealth transfer plan For Financial Professional Use Only. Not for Use With Consumers. 13

14 For Financial Professional Use Only. Not for Use With Consumers.

We're with you at every step Helping you with what matters most to clients We’re here to provide the tools and support you need to serve your clients, build trust and grow your business. You can rely on us for life insurance products that are focused on enhancing value and your success. Questions? We're happy to help. Contact your Protective Life representative for more support. For Financial Professional Use Only. Not for Use With Consumers. 15 For Financial Professional Use Only. Not for Use With Consumers. 15

1 2022 Insurance Barometer Study, LIMRA, Life Happens. April 2022. page 7. 2 LIMRA: Facts of Life and Annuities, 2022 Protective and Protective Life refer to Protective Life Insurance Company (PLICO) and its afÏliates, including Protective Life and Annuity Company (PLAIC). PLICO, founded in 1907, is located in Nashville, TN, and is licensed in all states excluding New York. PLAIC is located in Birmingham, AL, and is licensed in New York. Product availability and features may vary by state. Each company is solely responsible for the financial obligations accruing under the products it issues. Product guarantees are backed by the financial strength and claims paying ability of the issuing company. The Protective trademarks, logos and service marks are property of Protective Life Insurance Company and are protected by copyright, trademark, and/or other proprietary rights and laws. Not FDIC/NCUA Insured Not Bank or Credit Union Guaranteed Not a Deposit Not Insured By Any Federal Government Agency May Lose Value CLA.4848102 (10.24) For Financial Professional Use Only. Not for Use With Consumers.