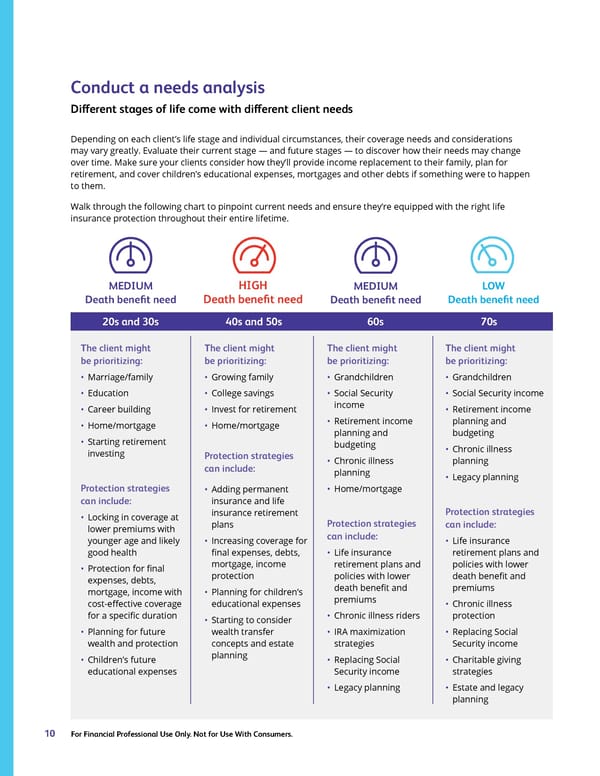

Conduct a needs analysis Different stages of life come with different client needs Depending on each client’s life stage and individual circumstances, their coverage needs and considerations may vary greatly. Evaluate their current stage — and future stages — to discover how their needs may change over time. Make sure your clients consider how they’ll provide income replacement to their family, plan for retirement, and cover children’s educational expenses, mortgages and other debts if something were to happen to them. Walk through the following chart to pinpoint current needs and ensure they’re equipped with the right life insurance protection throughout their entire lifetime. MEDIUM HIGH MEDIUM LOW Death benefit need Death benefit need Death benefit need Death benefit need 20s and 30s 40s and 50s 60s 70s The client might The client might The client might The client might be prioritizing: be prioritizing: be prioritizing: be prioritizing: • Marriage/family • Growing family • Grandchildren • Grandchildren • Education • College savings • Social Security • Social Security income • Career building • Invest for retirement income • Retirement income • Home/mortgage • Home/mortgage • Retirement income planning and • Starting retirement planning and budgeting investing budgeting • Chronic illness Protection strategies • Chronic illness planning can include: planning • Legacy planning Protection strategies • Adding permanent • Home/mortgage can include: insurance and life • Locking in coverage at insurance retirement Protection strategies plans Protection strategies can include: lower premiums with can include: • Increasing coverage for younger age and likely • Life insurance final expenses, debts, good health • Life insurance retirement plans and mortgage, income policies with lower • Protection for final retirement plans and protection death benefit and policies with lower expenses, debts, death benefit and premiums • Planning for children’s mortgage, income with premiums educational expenses cost-effective coverage • Chronic illness for a specific duration • Starting to consider • Chronic illness riders protection • Planning for future wealth transfer • IRA maximization • Replacing Social concepts and estate wealth and protection strategies Security income • Children’s future planning • Replacing Social • Charitable giving educational expenses Security income strategies • Legacy planning • Estate and legacy planning 10 For Financial Professional Use Only. Not for Use With Consumers.

Protective Life Insurance Guide Page 11 Page 13

Protective Life Insurance Guide Page 11 Page 13