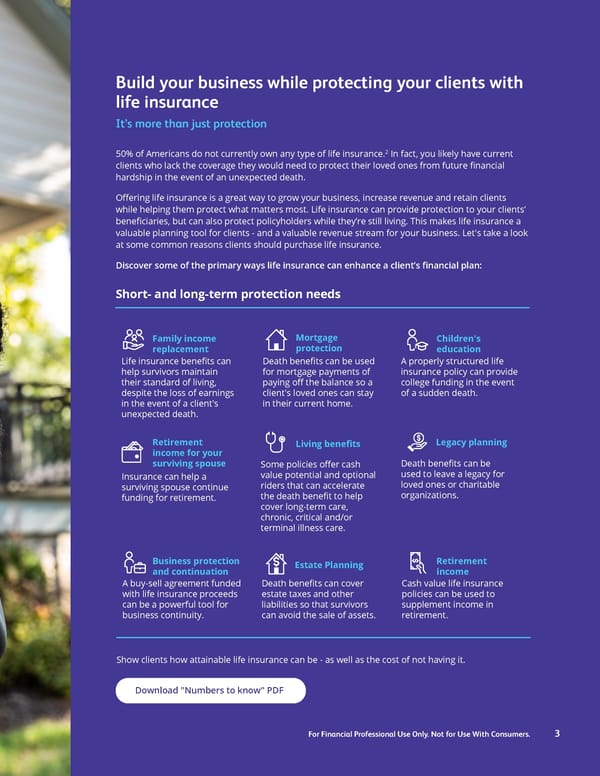

Build your business while protecting your clients with life insurance It’s more than just protection 2 50% of Americans do not currently own any type of life insurance. In fact, you likely have current clients who lack the coverage they would need to protect their loved ones from future financial hardship in the event of an unexpected death. Offering life insurance is a great way to grow your business, increase revenue and retain clients while helping them protect what matters most. Life insurance can provide protection to your clients’ beneficiaries, but can also protect policyholders while they’re still living. This makes life insurance a valuable planning tool for clients - and a valuable revenue stream for your business. Let's take a look at some common reasons clients should purchase life insurance. Discover some of the primary ways life insurance can enhance a client’s financial plan: Short- and long-term protection needs Mortgage Family income Children's protection replacement education Life insurance benefits can Death benefits can be used A properly structured life help survivors maintain for mortgage payments of insurance policy can provide their standard of living, paying off the balance so a college funding in the event despite the loss of earnings client's loved ones can stay of a sudden death. in the event of a client's in their current home. unexpected death. Retirement Legacy planning Living benefits income for your Death benefits can be surviving spouse Some policies offer cash used to leave a legacy for value potential and optional Insurance can help a loved ones or charitable riders that can accelerate surviving spouse continue organizations. the death benefit to help funding for retirement. cover long-term care, chronic, critical and/or terminal illness care. Retirement Business protection Estate Planning income and continuation A buy-sell agreement funded Death benefits can cover Cash value life insurance with life insurance proceeds estate taxes and other policies can be used to can be a powerful tool for liabilities so that survivors supplement income in business continuity. can avoid the sale of assets. retirement. Show clients how attainable life insurance can be - as well as the cost of not having it. Download "Numbers to know" PDF For Financial Professional Use Only. Not for Use With Consumers. 3

Protective Life Insurance Guide Page 4 Page 6

Protective Life Insurance Guide Page 4 Page 6