Aspirations_Digital_Kit_04_12_24

7% compounding ® roll-up rate Protective Aspirations Variable Annuity A variable annuity designed to deliver more. Maximized lifetime income Enhanced protection Added flexibility Not FDIC/NCUA Insured Not Bank or Credit Union Guaranteed Not a Deposit Not Insured By Any Federal Government Agency May Lose Value Protective refers to Protective Life Insurance Company. For Financial Professional Use Only. Not for Use With Consumers.

Saving for retirement is only half the battle Clients rely on you to provide strategies to help protect their unique aspirations for retirement, and an important objective of that plan is helping to secure lifetime income they can’t outlive. That’s why Protective® Aspirations variable annuity was designed to help clients achieve the highest guaranteed income in retirement while giving your clients the control and 昀氀exibility they need to help them actually reach their goals. With tax-deferred growth potential and a choice of 昀氀exible options for lifetime income and legacy protection, this highly-competitive income solution complements your clients’ portfolios while adding more security and protection to their retirement aspirations. Because everyone should retire with con昀椀dence. 2 For Financial Professional Use Only. Not for Use With Consumers.

Everything you need to help protect your clients’ retirement goals Holistic approach to retirement Competitive investment lineup • Asset protection and growth potential • Over 100 investment options from industry leading • Lifetime income fund managers spanning a broad range of asset classes • Wealth transfer • Tax-deferred growth potential Income 昀氀exibility Enhanced legacy planning • O昀昀ers the choice of two optional protected lifetime Multiple death bene昀椀t options to 昀椀t your clients’ income bene昀椀ts unique needs. SM • SecurePay Protector bene昀椀t o昀昀ers a 7% guaranteed Maximum Quarterly Value Death Bene昀椀t Option increases annual compounded growth rate, with the opportunity with the contract value and can be locked in each quarter. for additional growth by capturing annual market gains. SM • SecurePay Investor bene昀椀t is a cost-e昀昀ective solution Your sales team that o昀昀ers access to world class investment options and the ability to lock in investment gains annually. • Choose single or joint withdrawals when income starts. Dedicated team of specialists, programs and tools that can SM help you serve your clients and attract new ones • Both options include the SecurePay Reserve bene昀椀t which provides the 昀氀exibility to defer up to 3x the AWA Contact us for use at a later time. For Financial Professional Use Only. Not for Use With Consumers. 3

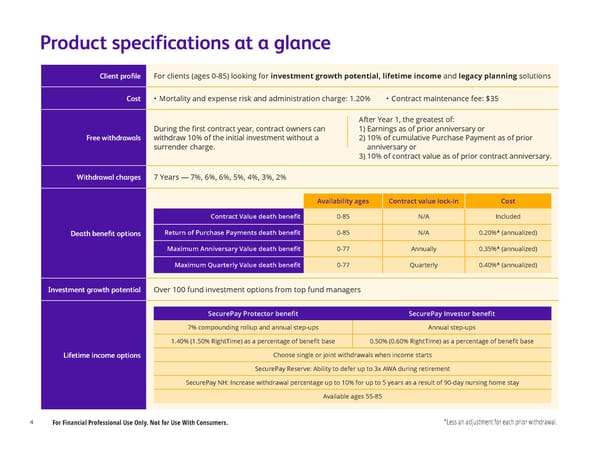

Product specifications at a glance Client pro昀椀le For clients (ages 0-85) looking for investment growth potential, lifetime income and legacy planning solutions Cost • Mortality and expense risk and administration charge: 1.20% • Contract maintenance fee: $35 After Year 1, the greatest of: During the 昀椀rst contract year, contract owners can 1) Earnings as of prior anniversary or Free withdrawals withdraw 10% of the initial investment without a 2) 10% of cumulative Purchase Payment as of prior surrender charge. anniversary or 3) 10% of contract value as of prior contract anniversary. Withdrawal charges 7 Years — 7%, 6%, 6%, 5%, 4%, 3%, 2% Availability ages Contract value lock-in Cost 0-85 N/A Included Contract Value death bene昀椀t 0-85 N/A 0.20%* (annualized) Death bene昀椀t options Return of Purchase Payments death bene昀椀t 0-77 Annually 0.35%* (annualized) Maximum Anniversary Value death bene昀椀t 0-77 Quarterly 0.40%* (annualized) Maximum Quarterly Value death bene昀椀t Investment growth potential Over 100 fund investment options from top fund managers SecurePay Protector bene昀椀t SecurePay Investor bene昀椀t 7% compounding rollup and annual step-ups Annual step-ups 1.40% (1.50% RightTime) as a percentage of bene昀椀t base 0.50% (0.60% RightTime) as a percentage of bene昀椀t base Lifetime income options Choose single or joint withdrawals when income starts SecurePay Reserve: Ability to defer up to 3x AWA during retirement SecurePay NH: Increase withdrawal percentage up to 10% for up to 5 years as a result of 90-day nursing home stay Available ages 55-85 4 For Financial Professional Use Only. Not for Use With Consumers. *Less an adjustment for each prior withdrawal.

For Financial Professional Use Only. Not for Use With Consumers. 5

Investment options from leading fund managers 6 For Financial Professional Use Only. Not for Use With Consumers.

Investment management With a variable annuity from Protective, you can diversify your investments among several options from established fund managers. We select each fund manager for their high level of professional credentials and experience. They’re responsible for implementing each respective investment option’s strategy and managing its portfolio trading activities. Tax-free transfers among the various investment options may help maintain your preferred level of diversi昀椀cation. Certain limitations apply, so please see the product prospectus for more information. Diversi昀椀cation neither assures a pro昀椀t nor eliminates the risk of experiencing investment losses. See our investment options Protective Aspirations Variable Annuity o昀昀ers over 100 investment options from leading fund managers allowing you to build diversi昀椀ed portfolios that align with your clients’ goals. Learn more For Financial Professional Use Only. Not for Use With Consumers. 7

8 For Financial Professional Use Only. Not for Use With Consumers.

Protector 7% compounding roll-up rate Maximize and protect retirement income with SecurePay Protector benefit • Guaranteed annual 7% compounding bene昀椀t Is your client a base growth • Annual step-ups can capture positive market protector or investor? performance and grow clients’ bene昀椀t base • Competitive, age-based withdrawal rates provide protected lifetime income Whether your client needs protected or lifetime income during retirement, or they’re looking to safeguard their market gains Investor and maximize their savings — the optional lifetime income bene昀椀ts available with ® Maximize growth potential with Protective Aspirations variable annuity can help. SecurePay Investor benefit • 100% subaccount investment 昀氀exibility in quality investment options Curious which rider 昀椀ts best with your clients’ • Cost-e昀昀ective at only 0.50% of bene昀椀t base unique retirement goals? Download this quick guide. • Opportunities to lock in market gains with annual bene昀椀t base step-ups Download guide Allocation of purchase payments or contract value to the 昀椀xed account is not permitted under the SecurePay Investor or SecurePay Protector bene昀椀t. For Financial Professional Use Only. Not for Use With Consumers. 9

7% compounding SecurePay roll-up rate Protector benefit ℠ The SecurePay Protector bene昀椀t o昀昀ers a solution for clients who will rely on a guaranteed income stream, but still want the ability to capitalize on market-driven growth potential. 10 For Financial Professional Use Only. Not for Use With Consumers.

Income now or later Prioritizes guarantees and growth Seeks competitive withdrawal rates For Financial Professional Use Only. Not for Use With Consumers. 11

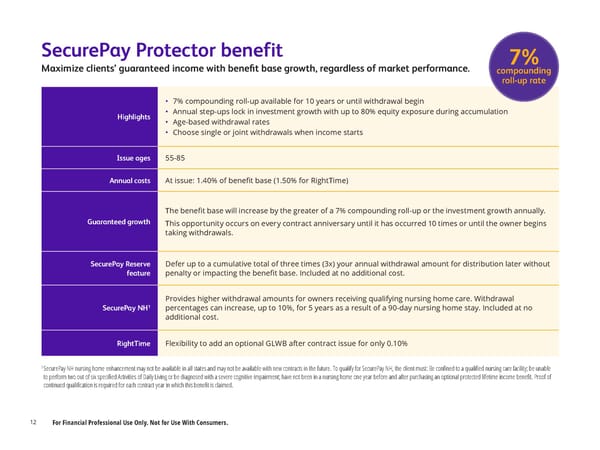

SecurePay Protector benefit 7% Maximize clients’ guaranteed income with bene昀椀t base growth, regardless of market performance. compounding roll-up rate • 7% compounding roll-up available for 10 years or until withdrawal begin Highlights • Annual step-ups lock in investment growth with up to 80% equity exposure during accumulation • Age-based withdrawal rates • Choose single or joint withdrawals when income starts Issue ages 55-85 Annual costs At issue: 1.40% of bene昀椀t base (1.50% for RightTime) The bene昀椀t base will increase by the greater of a 7% compounding roll-up or the investment growth annually. Guaranteed growth This opportunity occurs on every contract anniversary until it has occurred 10 times or until the owner begins taking withdrawals. SecurePay Reserve Defer up to a cumulative total of three times (3x) your annual withdrawal amount for distribution later without feature penalty or impacting the bene昀椀t base. Included at no additional cost. Provides higher withdrawal amounts for owners receiving qualifying nursing home care. Withdrawal 1 SecurePay NH percentages can increase, up to 10%, for 5 years as a result of a 90-day nursing home stay. Included at no additional cost. RightTime Flexibility to add an optional GLWB after contract issue for only 0.10% 1 SecurePay NH nursing home enhancement may not be available in all states and may not be available with new contracts in the future. To qualify for SecurePay NH, the client must: Be con昀椀ned to a quali昀椀ed nursing care facility; be unable to perform two out of six speci昀椀ed Activities of Daily Living or be diagnosed with a severe cognitive impairment; have not been in a nursing home one year before and after purchasing an optional protected lifetime income bene昀椀t. Proof of continued quali昀椀cation is required for each contract year in which this bene昀椀t is claimed. 12 For Financial Professional Use Only. Not for Use With Consumers.

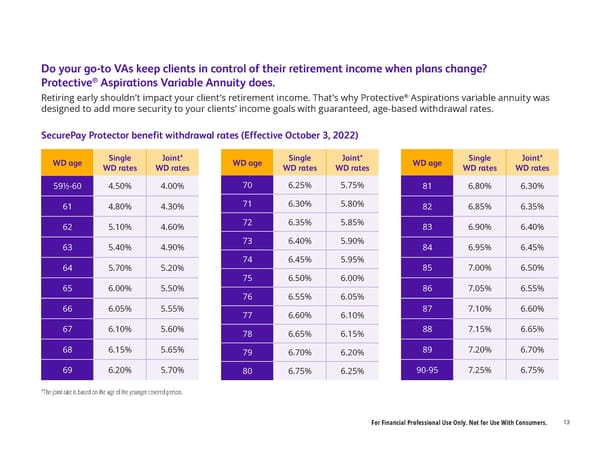

Do your go-to VAs keep clients in control of their retirement income when plans change? ® Protective Aspirations Variable Annuity does. Retiring early shouldn’t impact your client’s retirement income. That’s why Protective® Aspirations variable annuity was designed to add more security to your clients’ income goals with guaranteed, age-based withdrawal rates. SecurePay Protector benefit withdrawal rates (Effective October 3, 2022) WD age Single Joint* WD age Single Joint* WD age Single Joint* WD rates WD rates WD rates WD rates WD rates WD rates 70 6.25% 5.75% 81 6.80% 6.30% 59½-60 4.50% 4.00% 71 6.30% 5.80% 82 6.85% 6.35% 61 4.80% 4.30% 72 6.35% 5.85% 83 6.90% 6.40% 62 5.10% 4.60% 73 6.40% 5.90% 84 6.95% 6.45% 63 5.40% 4.90% 74 6.45% 5.95% 85 7.00% 6.50% 64 5.70% 5.20% 75 6.50% 6.00% 86 7.05% 6.55% 65 6.00% 5.50% 76 6.55% 6.05% 87 7.10% 6.60% 66 6.05% 5.55% 77 6.60% 6.10% 88 7.15% 6.65% 67 6.10% 5.60% 78 6.65% 6.15% 89 7.20% 6.70% 68 6.15% 5.65% 79 6.70% 6.20% 90-95 7.25% 6.75% 69 6.20% 5.70% 80 6.75% 6.25% *The joint rate is based on the age of the younger covered person. For Financial Professional Use Only. Not for Use With Consumers. 13

Allocation by Investment Categories (AIC) Investing with the for enhanced 昀氀exibility. optional SecurePay Protector benefit Protective Allocation Portfolios for a turnkey approach. Help clients customize a portfolio that aligns with their retirement strategy. Select from a blend of leading investment options or choose ® from preselected allocation options American Funds Insurance Series to simplify the process and leverage Allocation Portfolios for objective-based growth potential. the power of tax deferral. Protective Life Dynamic Allocation Series Portfolios to mitigate downside risk. 14 For Financial Professional Use Only. Not for Use With Consumers.

For Financial Professional Use Only. Not for Use With Consumers. 15

Shifting aspirations from saving to living in retirement Your clients have di昀昀erent needs and face di昀昀erent challenges when saving for retirement versus living o昀昀 their retirement savings. That’s why the options available in the accumulation phase are designed to help to provide growth opportunities for your clients’ assets based on market performance, while the ones available in the distribution phase are designed to make sure their income lasts for a lifetime. 16 For Financial Professional Use Only. Not for Use With Consumers.

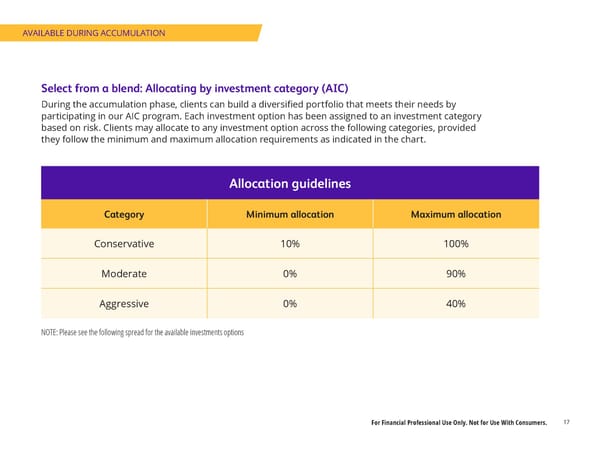

AVAILABLE DURING ACCUMULATION Select from a blend: Allocating by investment category (AIC) During the accumulation phase, clients can build a diversi昀椀ed portfolio that meets their needs by participating in our AIC program. Each investment option has been assigned to an investment category based on risk. Clients may allocate to any investment option across the following categories, provided they follow the minimum and maximum allocation requirements as indicated in the chart. Allocation guidelines Category Minimum allocation Maximum allocation Conservative 10% 100% Moderate 0% 90% Aggressive 0% 40% NOTE: Please see the following spread for the available investments options For Financial Professional Use Only. Not for Use With Consumers. 17

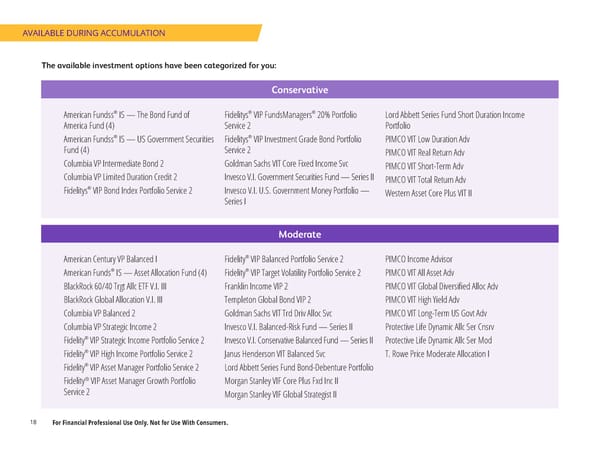

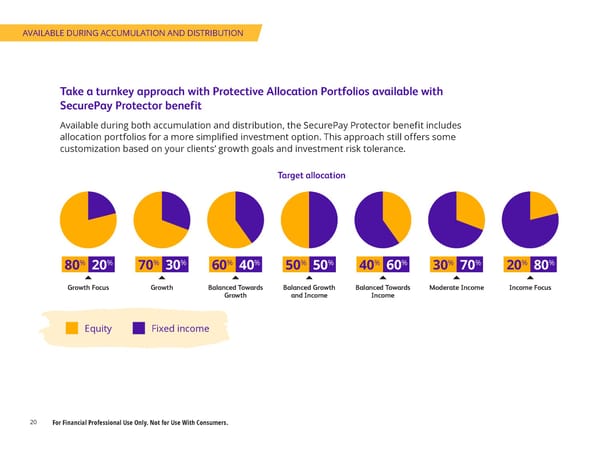

AVAILABLE DURING ACCUMULATION The available investment options have been categorized for you: Conservative ® ® ® American Fundss IS — The Bond Fund of Fidelitys VIP FundsManagers 20% Portfolio Lord Abbett Series Fund Short Duration Income America Fund (4) Service 2 Portfolio ® ® American Fundss IS — US Government Securities Fidelitys VIP Investment Grade Bond Portfolio PIMCO VIT Low Duration Adv Fund (4) Service 2 PIMCO VIT Real Return Adv Columbia VP Intermediate Bond 2 Goldman Sachs VIT Core Fixed Income Svc PIMCO VIT Short-Term Adv Columbia VP Limited Duration Credit 2 Invesco V.I. Government Securities Fund — Series II PIMCO VIT Total Return Adv ® Fidelitys VIP Bond Index Portfolio Service 2 Invesco V.I. U.S. Government Money Portfolio — Western Asset Core Plus VIT II Series I Moderate ® American Century VP Balanced I Fidelity VIP Balanced Portfolio Service 2 PIMCO Income Advisor ® ® American Funds IS — Asset Allocation Fund (4) Fidelity VIP Target Volatility Portfolio Service 2 PIMCO VIT All Asset Adv BlackRock 60/40 Trgt Allc ETF V.I. III Franklin Income VIP 2 PIMCO VIT Global Diversi昀椀ed Alloc Adv BlackRock Global Allocation V.I. III Templeton Global Bond VIP 2 PIMCO VIT High Yield Adv Columbia VP Balanced 2 Goldman Sachs VIT Trd Driv Alloc Svc PIMCO VIT Long-Term US Govt Adv Columbia VP Strategic Income 2 Invesco V.I. Balanced-Risk Fund — Series II Protective Life Dynamic Allc Ser Cnsrv ® Fidelity VIP Strategic Income Portfolio Service 2 Invesco V.I. Conservative Balanced Fund — Series II Protective Life Dynamic Allc Ser Mod ® Fidelity VIP High Income Portfolio Service 2 Janus Henderson VIT Balanced Svc T. Rowe Price Moderate Allocation I ® Fidelity VIP Asset Manager Portfolio Service 2 Lord Abbett Series Fund Bond-Debenture Portfolio Fidelity® VIP Asset Manager Growth Portfolio Morgan Stanley VIF Core Plus Fxd Inc II Service 2 Morgan Stanley VIF Global Strategist II 18 For Financial Professional Use Only. Not for Use With Consumers.

Aggressive ® AB Relative Value B Fidelity VIP Health Care Portfolio Service 2 PortfolioLord Abbett Series Fund Fundamental ® Equity Portfolio AB VPS Large Cap Growth B Fidelity VIP Index 500 Portfolio Service 2 ® ® ® American Funds IS — Capital World Growth & Fidelity VIP Mid Cap Portfolio Service 2 MFS VIT Growth Svc ® Income Fund (4) ClearBridge Variable Dividend Strat II MFS VIT II Core Equity Svc ® ® American Funds IS — Global Growth Fund (4) ClearBridge Variable Large Cap Growth II MFS VIT II International Growth Svc ® ® American Funds IS — Growth Fund (4) Franklin Rising Dividends VIP 2 MFS VIT II International Intrs Val Svc ® ® American Funds IS — Growth-Income Fund (4) Goldman Sachs VIT Mid Cap Growth Svc MFS VIT II MA Investors Growth Stk Svc ® ® American Funds IS — International Growth And Goldman Sachs VIT Mid Cap Value Svc MFS VIT Total Return Svc IncomeFund (4) Goldman Sachs VIT Strategic Growth Svc Protective Life Dynamic Allc Ser Gr ® American Funds IS - Washington Mutual Investors Invesco V.I. Comstock Fund — Series II T. Rowe Price Blue Chip Growth Port II Fund (4) Invesco V.I. Equity and Income Fund — Series II T. Rowe Price Mid-Cap Growth Port II BlackRock International V.I. I Invesco V.I. Growth and Income Fund — Series II BlackRock Advantage SMID Cap V.I. Fd III Invesco V.I. Main Street Mid Cap Fund — Series II ® Fidelity VIP Growth Portfolio Service 2 Janus Henderson VIT Enterprise Svc ® Fidelity VIP Growth & Income Portfolio Service 2 Janus Henderson VIT Forty Svc ® ® Fidelity VIP FundsManager 85% Portfolio Lord Abbett Series Fund Dividend Growth Service 2 For Financial Professional Use Only. Not for Use With Consumers. 19

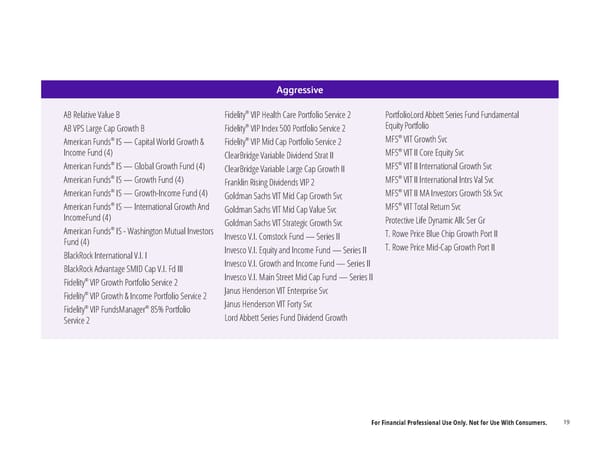

AVAILABLE DURING ACCUMULATION AND DISTRIBUTION Take a turnkey approach with Protective Allocation Portfolios available with SecurePay Protector benefit Available during both accumulation and distribution, the SecurePay Protector benefit includes allocation portfolios for a more simplified investment option. This approach still offers some customization based on your clients’ growth goals and investment risk tolerance. Target allocation % % % % % % % % % % % % % % 80 20 70 30 60 40 50 50 40 60 30 70 20 80 Growth Focus Growth Balanced Towards Balanced Growth Balanced Towards Moderate Income Income Focus Growth and Income Income Equity Fixed income 20 For Financial Professional Use Only. Not for Use With Consumers.

AVAILABLE DURING ACCUMULATION AND DISTRIBUTION ® For objective-based growth potential, explore American Funds Insurance Series Allocation Portfolios available with SecurePay Protector benefit * Protective Aspirations variable annuity also offers allocation options featuring the American Funds Insurance Series. Each option blends individual funds within American Funds Insurance Series that can help meet your retirement goals. Target allocation % % % % % % % % % % % % % % 80 20 80 20 65 35 65 35 50 50 50 50 40 60 Global Growth Growth Global Growth Growth Global Balanced Balanced Conservative and Income and Income Growth and Growth and Income Income Equity Fixed income Learn more about the available allocation portfolios options here. Learn more For Financial Professional Use Only. Not for Use With Consumers. 21

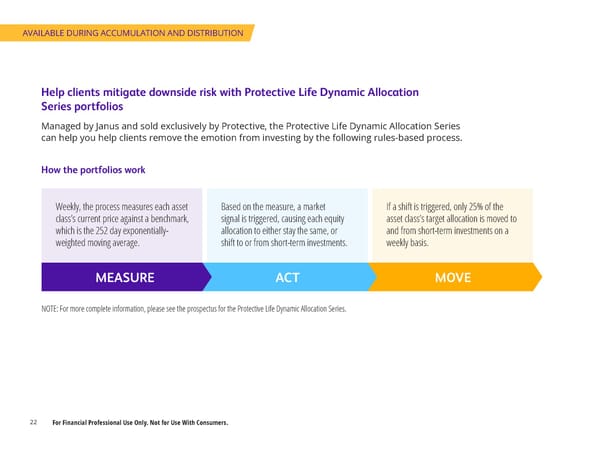

AVAILABLE DURING ACCUMULATION AND DISTRIBUTION Help clients mitigate downside risk with Protective Life Dynamic Allocation Series portfolios Managed by Janus and sold exclusively by Protective, the Protective Life Dynamic Allocation Series can help you help clients remove the emotion from investing by the following rules-based process. How the portfolios work Weekly, the process measures each asset Based on the measure, a market If a shift is triggered, only 25% of the class’s current price against a benchmark, signal is triggered, causing each equity asset class’s target allocation is moved to which is the 252 day exponentially- allocation to either stay the same, or and from short-term investments on a weighted moving average. shift to or from short-term investments. weekly basis. MEASURE ACT MOVE NOTE: For more complete information, please see the prospectus for the Protective Life Dynamic Allocation Series. 22 For Financial Professional Use Only. Not for Use With Consumers.

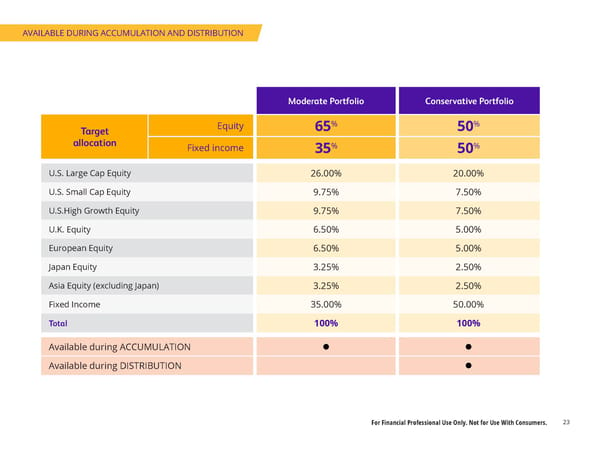

AVAILABLE DURING ACCUMULATION AND DISTRIBUTION Moderate Portfolio Conservative Portfolio % % Target Equity 65 50 allocation % % Fixed income 35 50 U.S. Large Cap Equity 26.00% 20.00% U.S. Small Cap Equity 9.75% 7.50% U.S.High Growth Equity 9.75% 7.50% U.K. Equity 6.50% 5.00% European Equity 6.50% 5.00% Japan Equity 3.25% 2.50% Asia Equity (excluding Japan) 3.25% 2.50% Fixed Income 35.00% 50.00% Total 100% 100% Available during ACCUMULATION Available during DISTRIBUTION For Financial Professional Use Only. Not for Use With Consumers. 23

SecurePay Investor benefit ℠ The SecurePay Investor bene昀椀t o昀昀ers a solution for clients who want to capture market gains and maximize their retirement income with a safety net of guaranteed income for life, should they need it later. 24 For Financial Professional Use Only. Not for Use With Consumers.

Income maybe Prioritizes investment 昀氀exibility Seeks growth potential For Financial Professional Use Only. Not for Use With Consumers. 25

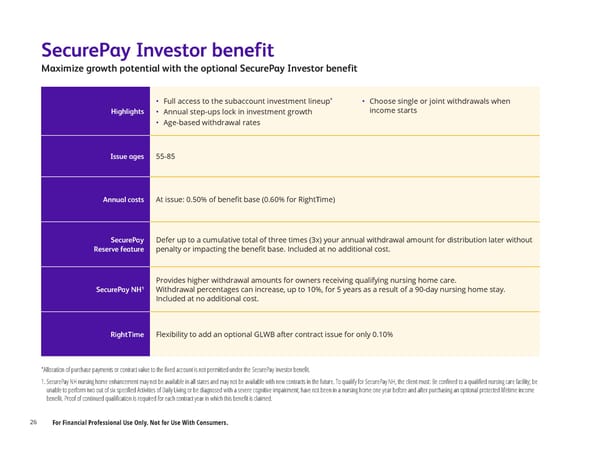

SecurePay Investor benefit Maximize growth potential with the optional SecurePay Investor benefit * • Full access to the subaccount investment lineup • Choose single or joint withdrawals when Highlights • Annual step-ups lock in investment growth income starts • Age-based withdrawal rates Issue ages 55-85 Annual costs At issue: 0.50% of bene昀椀t base (0.60% for RightTime) SecurePay Defer up to a cumulative total of three times (3x) your annual withdrawal amount for distribution later without Reserve feature penalty or impacting the bene昀椀t base. Included at no additional cost. Provides higher withdrawal amounts for owners receiving qualifying nursing home care. SecurePay NH1 Withdrawal percentages can increase, up to 10%, for 5 years as a result of a 90-day nursing home stay. Included at no additional cost. RightTime Flexibility to add an optional GLWB after contract issue for only 0.10% *Allocation of purchase payments or contract value to the 昀椀xed account is not permitted under the SecurePay Investor bene昀椀t. 1. SecurePay NH nursing home enhancement may not be available in all states and may not be available with new contracts in the future. To qualify for SecurePay NH, the client must: Be con昀椀ned to a quali昀椀ed nursing care facility; be unable to perform two out of six speci昀椀ed Activities of Daily Living or be diagnosed with a severe cognitive impairment; have not been in a nursing home one year before and after purchasing an optional protected lifetime income bene昀椀t. Proof of continued quali昀椀cation is required for each contract year in which this bene昀椀t is claimed. 26 For Financial Professional Use Only. Not for Use With Consumers.

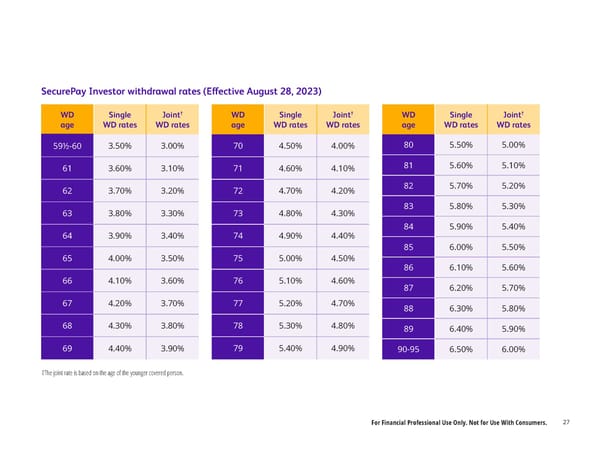

SecurePay Investor withdrawal rates (E昀昀ective August 28, 2023) † † † WD Single Joint WD Single Joint WD Single Joint age WD rates WD rates age WD rates WD rates age WD rates WD rates 80 5.50% 5.00% 3.50% 3.00% 70 4.50% 4.00% 59½-60 81 5.60% 5.10% 61 3.60% 3.10% 71 4.60% 4.10% 82 5.70% 5.20% 62 3.70% 3.20% 72 4.70% 4.20% 83 5.80% 5.30% 63 3.80% 3.30% 73 4.80% 4.30% 84 5.90% 5.40% 64 3.90% 3.40% 74 4.90% 4.40% 85 6.00% 5.50% 65 4.00% 3.50% 75 5.00% 4.50% 86 6.10% 5.60% 66 4.10% 3.60% 76 5.10% 4.60% 87 6.20% 5.70% 67 4.20% 3.70% 77 5.20% 4.70% 88 6.30% 5.80% 68 4.30% 3.80% 78 5.30% 4.80% 89 6.40% 5.90% 79 5.40% 4.90% 69 4.40% 3.90% 90-95 6.50% 6.00% †The joint rate is based on the age of the younger covered person. For Financial Professional Use Only. Not for Use With Consumers. 27

Built-in options to prepare for the unexpected Clients want to be con昀椀dent that their retirement goals are protected, no matter what life has in store. Start building con昀椀dence with a protected lifetime income stream that o昀昀ers the control and 昀氀exibility you need to react to changes in your clients’ retirement plans. Available with both optional lifetime income bene昀椀ts, Protective Aspirations variable annuity o昀昀ers these thoughtful, value-added features to help clients who need more 昀氀exibility. 28 For Financial Professional Use Only. Not for Use With Consumers.

See additional features For Financial Professional Use Only. Not for Use With Consumers. 29

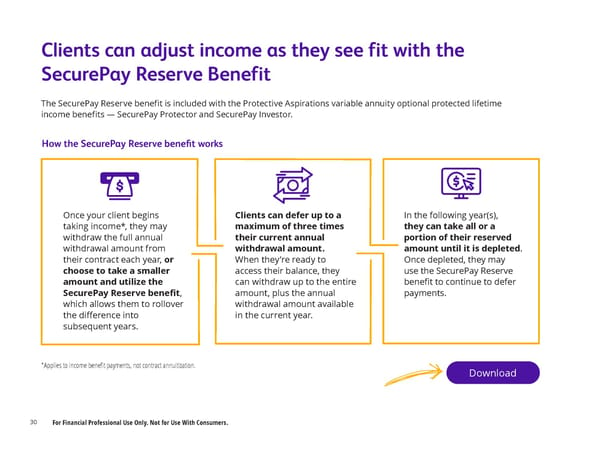

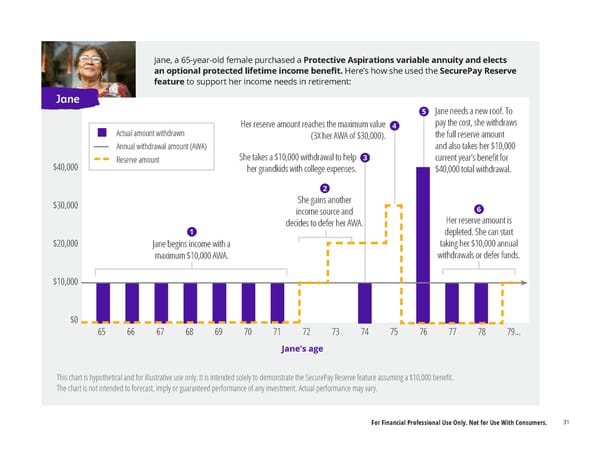

Clients can adjust income as they see fit with the SecurePay Reserve Benefit The SecurePay Reserve benefit is included with the Protective Aspirations variable annuity optional protected lifetime income benefits — SecurePay Protector and SecurePay Investor. How the SecurePay Reserve bene昀椀t works Once your client begins Clients can defer up to a In the following year(s), taking income*, they may maximum of three times they can take all or a withdraw the full annual their current annual portion of their reserved withdrawal amount from withdrawal amount. amount until it is depleted. their contract each year, or When they’re ready to Once depleted, they may choose to take a smaller access their balance, they use the SecurePay Reserve amount and utilize the can withdraw up to the entire bene昀椀t to continue to defer SecurePay Reserve bene昀椀t, amount, plus the annual payments. which allows them to rollover withdrawal amount available the di昀昀erence into in the current year. subsequent years. *Applies to income bene昀椀t payments, not contract annuitization. Download 30 For Financial Professional Use Only. Not for Use With Consumers.

Jane, a 65-year-old female purchased a Protective Aspirations variable annuity and elects an optional protected lifetime income bene昀椀t. Here’s how she used the SecurePay Reserve feature to support her income needs in retirement: Jane 5 Jane needs a new roof. To Her reserve amount reaches the maximum value 4 pay the cost, she withdraws Actual amount withdrawn the full reserve amount (3X her AWA of $30,000). Annual withdrawal amount (AWA) and also takes her $10,000 She takes a $10,000 withdrawal to help 3 Reserve amount current year’s bene昀椀t for $40,000 her grandkids with college expenses. $40,000 total withdrawal. 2 She gains another $30,000 income source and 6 decides to defer her AWA. Her reserve amount is 1 depleted. She can start $20,000 Jane begins income with a taking her $10,000 annual withdrawals or defer funds. maximum $10,000 AWA. $10,000 $0 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79… Jane’s age This chart is hypothetical and for illustrative use only. It is intended solely to demonstrate the SecurePay Reserve feature assuming a $10,000 bene昀椀t. The chart is not intended to forecast, imply or guaranteed performance of any investment. Actual performance may vary. For Financial Professional Use Only. Not for Use With Consumers. 31

32 For Financial Professional Use Only. Not for Use With Consumers.

SecurePay NH Living longer and the costs associated with aging can have a signi昀椀cant impact on your clients’ retirement savings. Preparing now for potential nursing home care is an essential part of their long-term planning. In certain situations, SecurePay NH allows clients to increase their annual withdrawal percentage to a maximum of 10% for up to 昀椀ve years if con昀椀ned to a nursing home and meet certain eligibility requirements. It can provide another layer of protection if plans change. RightTime The solutions you choose to help protect your clients’ retirement income should be 昀氀exible enough to react to their changing needs over time. With RightTime, clients can make their decision later for an additional 0.10% to the optional income bene昀椀t fee versus adding an optional guaranteed income bene昀椀t at issue. This way, they don’t have to decide upfront — they have the 昀氀exibility to add an income option later for no additional fee. For Financial Professional Use Only. Not for Use With Consumers. 33

34 For Financial Professional Use Only. Not for Use With Consumers.

Multiple options to enhance legacy protection ® Protective Aspirations variable annuity gives clients the 昀氀exibility, control and protection they need to streamline the wealth transfer process. And with one standard death bene昀椀t option included at no additional cost, and three enhanced death bene昀椀t options, it can be tailored to 昀椀t your clients’ unique needs. Enhanced death benefit options: Help your clients provide for Return of Purchase Payments death bene昀椀t their loved ones and transfer Returns the investment or contract value, whichever is greater at wealth efficiently. time of death, less withdrawals.2 Maximum Anniversary Value death bene昀椀t Market gains can be locked in each contract anniversary to increase the Download the brochure 3 value of the death bene昀椀t, less any withdrawals. Maximum Quarterly Value death bene昀椀t Market gains can be captured to increase the death bene昀椀t on a quarterly basis, less any withdrawals.4 2. The Return of Purchase Payments death bene昀椀t is available at an additional cost equal to 0.20% (on an annualized basis) of the death bene昀椀t at the beginning of each contract month. Your clients’ retirement aspirations are worth protecting. Learn how Protective Aspirations 3. The Maximum Anniversary Value death bene昀椀t is available at variable annuity can help you build a customizable solution for maximizing your clients' an additional cost of 0.35% (on an annualized basis) of the death bene昀椀t at the beginning of each contract month. guaranteed income, tax-deferred growth potential, and 昀椀nancial legacy. 4. The Maximum Quarterly Value death bene昀椀t is available at an additional cost equal to 0.40% (on an annualized basis) of the Contact your Protective representative at 888-340-3428 death bene昀椀t at the beginning of each contract month. for more information. For Financial Professional Use Only. Not for Use With Consumers. 35

Make a di昀昀erence in your client’s retirement At Protective, our promise is in our name: we help you protect retirement. See how the Protective Aspirations variable annuity can help your clients that are looking for investment growth potential, lifetime income and legacy planning solutions. Best of all, our promises are backed by a company with the 昀椀nancial strength to deliver on its promises. Contact your sales team ® Learn more about Protective Aspirations variable annuity and tap into a dedicated team of specialists, programs and tools that can help you better serve your clients. Get in touch 36 For Financial Professional Use Only. Not for Use With Consumers.

For Financial Professional Use Only. Not for Use With Consumers. 37

finpro.protective.com Protective® refers to Protective Life Insurance Company (PLICO), Nashville, TN. Variable annuities are distributed by Investment Distributors, Inc. (IDI), Birmingham, AL, a broker-dealer and the principal underwriter for registered products issued by PLICO, its a昀케liate. Product guarantees are backed by the 昀椀nancial strength and claims-paying ability of PLICO. Protective® is a registered trademark of PLICO. The Protective trademarks, logos and service marks are property of PLICO and are protected by copyright, trademark, and/or other proprietary rights and laws. SecurePay NH nursing home enhancement may not be available in all states and may not be available with new contracts in the future. To qualify for SecurePay NH, the client must: Be con昀椀ned to a quali昀椀ed nursing care facility; be unable to perform two out of six speci昀椀ed Activities of Daily Living or be diagnosed with a severe cognitive impairment; have not been in a nursing home one year before and after purchasing an optional protected lifetime income bene昀椀t. Proof of continued quali昀椀cation is required for each contract year in which this bene昀椀t is claimed. Protective Aspirations variable annuity is a 昀氀exible premium deferred variable and 昀椀xed annuity contract issued by PLICO in all states except New York under policy form series VDA-P-2006. SecurePay Investor bene昀椀ts issued under rider form number VDA-P-6063. SecurePay Protector bene昀椀ts issued under rider form number VDA-P-6061. SecurePay Nursing Home bene昀椀ts issued under form number IPV-2159. Policy form numbers, product availability and product features may vary by state. Withdrawals reduce the annuity’s remaining death bene昀椀t, contract value, cash surrender value and future earnings. Withdrawals may be subject to income tax and, if taken prior to age 59½, an additional 10% IRS tax penalty may apply. More frequent withdrawals may reduce earnings more than annual withdrawals. During the withdrawal charge period, withdrawals in excess of the penalty-free amount may be subject to a withdrawal charge. Variable annuities are long-term investments intended for retirement planning and involve market risk and the possible loss of principal. Investments in variable annuities are subject to fees and changes from the insurance company and the investment managers. Neither Protective nor its representatives o昀昀er legal or tax advice. Purchasers should consult their attorney or tax advisor regarding their individual situation. Investors should carefully consider the investment objectives, risks, charges and expenses of a variable annuity, any optional protected lifetime income bene昀椀t, and the underlying investment options before investing. This and other information is contained in the prospectuses for a variable annuity and its underlying investment options. Investors should read the prospectuses carefully before investing. Prospectuses may be obtained by contacting PLICO at 800-456-6330. Not FDIC/NCUA Insured Not Bank or Credit Union Guaranteed Not a Deposit Not Insured By Any Federal Government Agency May Lose Value PABD.4391419.02.24 For Financial Professional Use Only. Not for Use With Consumers.