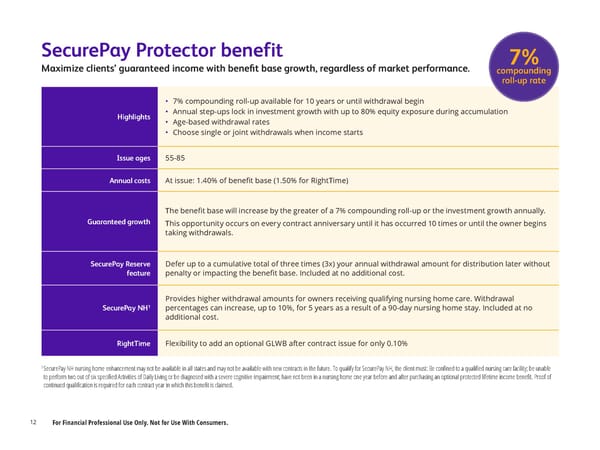

SecurePay Protector benefit 7% Maximize clients’ guaranteed income with bene昀椀t base growth, regardless of market performance. compounding roll-up rate • 7% compounding roll-up available for 10 years or until withdrawal begin Highlights • Annual step-ups lock in investment growth with up to 80% equity exposure during accumulation • Age-based withdrawal rates • Choose single or joint withdrawals when income starts Issue ages 55-85 Annual costs At issue: 1.40% of bene昀椀t base (1.50% for RightTime) The bene昀椀t base will increase by the greater of a 7% compounding roll-up or the investment growth annually. Guaranteed growth This opportunity occurs on every contract anniversary until it has occurred 10 times or until the owner begins taking withdrawals. SecurePay Reserve Defer up to a cumulative total of three times (3x) your annual withdrawal amount for distribution later without feature penalty or impacting the bene昀椀t base. Included at no additional cost. Provides higher withdrawal amounts for owners receiving qualifying nursing home care. Withdrawal 1 SecurePay NH percentages can increase, up to 10%, for 5 years as a result of a 90-day nursing home stay. Included at no additional cost. RightTime Flexibility to add an optional GLWB after contract issue for only 0.10% 1 SecurePay NH nursing home enhancement may not be available in all states and may not be available with new contracts in the future. To qualify for SecurePay NH, the client must: Be con昀椀ned to a quali昀椀ed nursing care facility; be unable to perform two out of six speci昀椀ed Activities of Daily Living or be diagnosed with a severe cognitive impairment; have not been in a nursing home one year before and after purchasing an optional protected lifetime income bene昀椀t. Proof of continued quali昀椀cation is required for each contract year in which this bene昀椀t is claimed. 12 For Financial Professional Use Only. Not for Use With Consumers.

Aspirations_Digital_Kit_04_12_24 Page 11 Page 13

Aspirations_Digital_Kit_04_12_24 Page 11 Page 13