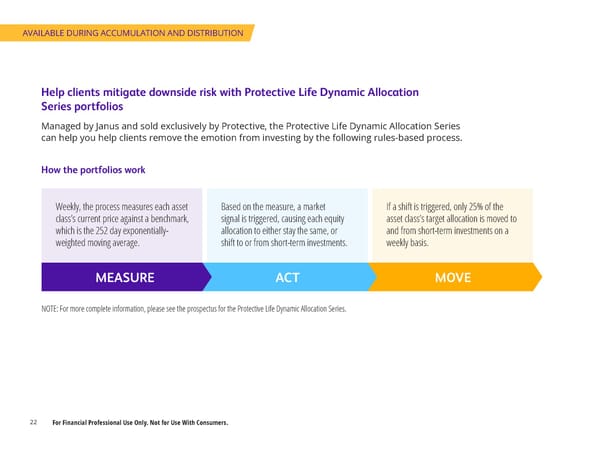

AVAILABLE DURING ACCUMULATION AND DISTRIBUTION Help clients mitigate downside risk with Protective Life Dynamic Allocation Series portfolios Managed by Janus and sold exclusively by Protective, the Protective Life Dynamic Allocation Series can help you help clients remove the emotion from investing by the following rules-based process. How the portfolios work Weekly, the process measures each asset Based on the measure, a market If a shift is triggered, only 25% of the class’s current price against a benchmark, signal is triggered, causing each equity asset class’s target allocation is moved to which is the 252 day exponentially- allocation to either stay the same, or and from short-term investments on a weighted moving average. shift to or from short-term investments. weekly basis. MEASURE ACT MOVE NOTE: For more complete information, please see the prospectus for the Protective Life Dynamic Allocation Series. 22 For Financial Professional Use Only. Not for Use With Consumers.

Aspirations_Digital_Kit_04_12_24 Page 21 Page 23

Aspirations_Digital_Kit_04_12_24 Page 21 Page 23