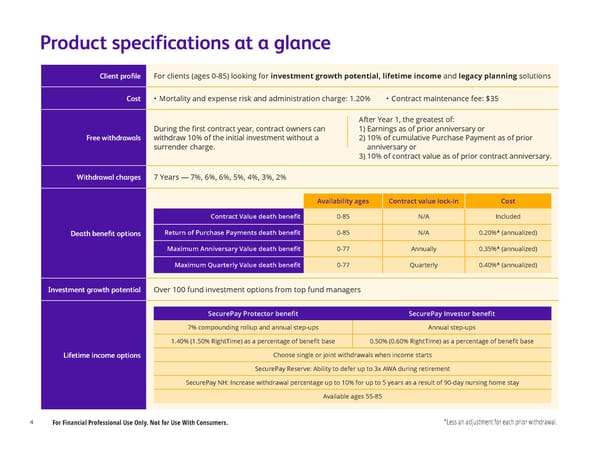

Product specifications at a glance Client pro昀椀le For clients (ages 0-85) looking for investment growth potential, lifetime income and legacy planning solutions Cost • Mortality and expense risk and administration charge: 1.20% • Contract maintenance fee: $35 After Year 1, the greatest of: During the 昀椀rst contract year, contract owners can 1) Earnings as of prior anniversary or Free withdrawals withdraw 10% of the initial investment without a 2) 10% of cumulative Purchase Payment as of prior surrender charge. anniversary or 3) 10% of contract value as of prior contract anniversary. Withdrawal charges 7 Years — 7%, 6%, 6%, 5%, 4%, 3%, 2% Availability ages Contract value lock-in Cost 0-85 N/A Included Contract Value death bene昀椀t 0-85 N/A 0.20%* (annualized) Death bene昀椀t options Return of Purchase Payments death bene昀椀t 0-77 Annually 0.35%* (annualized) Maximum Anniversary Value death bene昀椀t 0-77 Quarterly 0.40%* (annualized) Maximum Quarterly Value death bene昀椀t Investment growth potential Over 100 fund investment options from top fund managers SecurePay Protector bene昀椀t SecurePay Investor bene昀椀t 7% compounding rollup and annual step-ups Annual step-ups 1.40% (1.50% RightTime) as a percentage of bene昀椀t base 0.50% (0.60% RightTime) as a percentage of bene昀椀t base Lifetime income options Choose single or joint withdrawals when income starts SecurePay Reserve: Ability to defer up to 3x AWA during retirement SecurePay NH: Increase withdrawal percentage up to 10% for up to 5 years as a result of 90-day nursing home stay Available ages 55-85 4 For Financial Professional Use Only. Not for Use With Consumers. *Less an adjustment for each prior withdrawal.

Aspirations_Digital_Kit_04_12_24 Page 3 Page 5

Aspirations_Digital_Kit_04_12_24 Page 3 Page 5