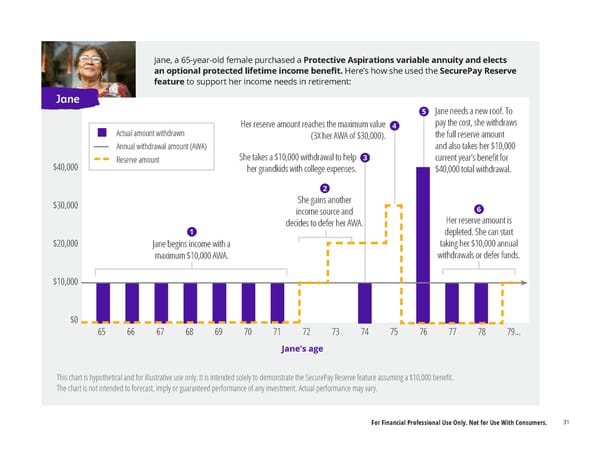

Jane, a 65-year-old female purchased a Protective Aspirations variable annuity and elects an optional protected lifetime income bene昀椀t. Here’s how she used the SecurePay Reserve feature to support her income needs in retirement: Jane 5 Jane needs a new roof. To Her reserve amount reaches the maximum value 4 pay the cost, she withdraws Actual amount withdrawn the full reserve amount (3X her AWA of $30,000). Annual withdrawal amount (AWA) and also takes her $10,000 She takes a $10,000 withdrawal to help 3 Reserve amount current year’s bene昀椀t for $40,000 her grandkids with college expenses. $40,000 total withdrawal. 2 She gains another $30,000 income source and 6 decides to defer her AWA. Her reserve amount is 1 depleted. She can start $20,000 Jane begins income with a taking her $10,000 annual withdrawals or defer funds. maximum $10,000 AWA. $10,000 $0 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79… Jane’s age This chart is hypothetical and for illustrative use only. It is intended solely to demonstrate the SecurePay Reserve feature assuming a $10,000 bene昀椀t. The chart is not intended to forecast, imply or guaranteed performance of any investment. Actual performance may vary. For Financial Professional Use Only. Not for Use With Consumers. 31

Aspirations_Digital_Kit_04_12_24 Page 30 Page 32

Aspirations_Digital_Kit_04_12_24 Page 30 Page 32